Eitc 2024 Calculator

Eitc 2024 Calculator. Extended due date for residents of maine and massachusetts. But one credit called the child and.

Here is a high level overview on how to qualify for the. Use this eic calculator to calculate your earned income credit based on the number of qualifying children, total earned income, and filing status.

Use This Calculator To Find Out:

The maximum amount you can get.

2023 Taxes, Calculators, Forms Pages.

Here is a high level overview on how to qualify for the.

Individuals Who Live In Maine And Massachusetts Have Until April 17, 2024, To File Their 2023 Form 1040.

Images References :

Source: detroitmi.gov

Source: detroitmi.gov

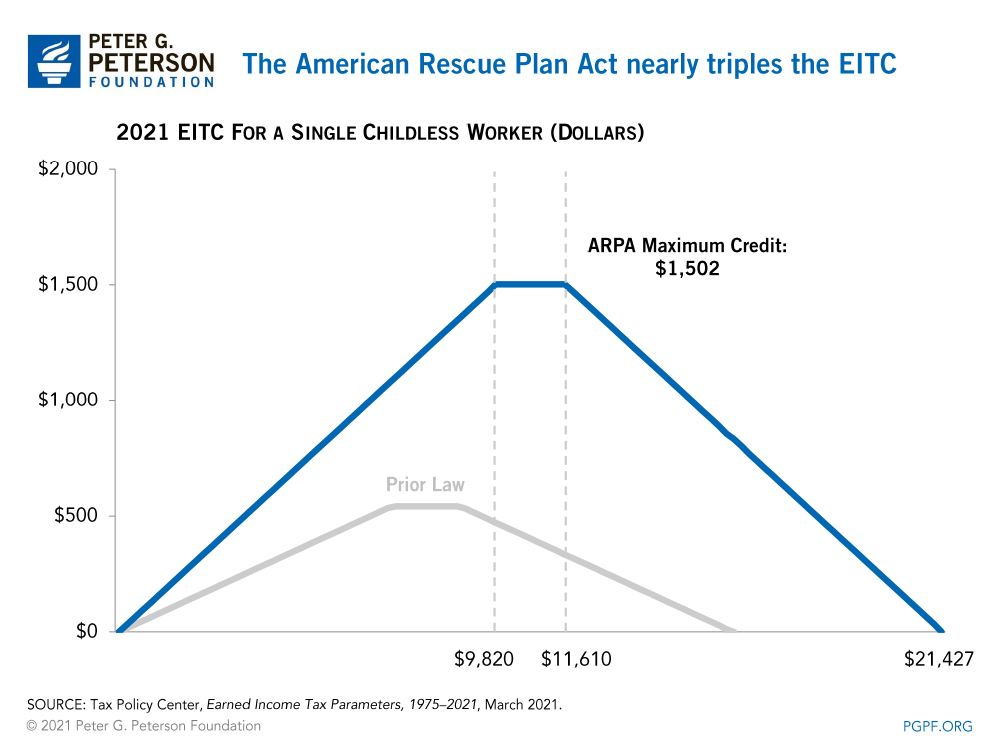

Earned Tax Credit City of Detroit, To qualify, you have to have worked in the year for. If you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may qualify for the earned.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2024 Earned Tax Credit Calculator & Table Internal Revenue, If you're eligible for the eitc. Use this eic calculator to calculate your earned income credit based on the number of qualifying children, total earned income, and filing status.

Source: brittniwtoni.pages.dev

Source: brittniwtoni.pages.dev

Eitc 2024 Release Date Donna Gayleen, The maximum amount you can get. If you earn $50,000 or less, then child care costs may be a huge burden for you.

Source: www.nalandaopenuniversity.com

Source: www.nalandaopenuniversity.com

Earned Tax Credit 2024 EITC Eligibility, Fill Online irs.gov, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the. 2023 taxes, calculators, forms pages.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, If you meet the tests for claiming. If you qualify, you can use the credit to reduce the.

Source: dorolisawsusie.pages.dev

Source: dorolisawsusie.pages.dev

2024 Tax Brackets Calculator Nedi Lorianne, The eitc is based on how many children you have and how much you make per year. Earned income tax credit in 2023.

Source: taxfoundation.org

Source: taxfoundation.org

The Earned Tax Credit (EITC) A Primer Tax Foundation, Claim back some of your child care costs. Everything you need to know about the earned income tax credit (eitc) in 2024.

Source: hydinsider.com

Source: hydinsider.com

Pubic Tips When Shaving HYD Insider, To qualify, you have to have worked in the year for. Individuals who live in maine and massachusetts have until april 17, 2024, to file their 2023 form 1040.

Source: theconservativenut.com

Source: theconservativenut.com

how is eitc calculated The Conservative Nut, Sick and family leave wages in 2024 for leave taken after march 31, 2020, and before october 1, 2021, are eligible to claim a credit for qualified sick and family leave wages in. To qualify, you have to have worked in the year for.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Earned Tax Credit Chart INCOBEMAN, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the. The credit is calculated based on your total earned income or your total adjusted gross income (agi), whichever is higher.

But One Credit Called The Child And.

If you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2023, you may qualify for the earned.

Use This Calculator See If You Qualify For The Earned Income Credit, And If So, How Much It Might Be Worth To You And Your Family.

To qualify, you have to have worked in the year for.