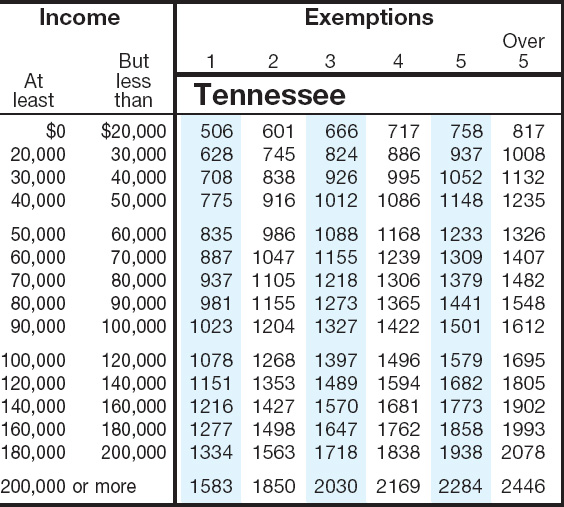

Tennessee Sales Tax Rate 2024

Tennessee Sales Tax Rate 2024. What is the tax rate range for tennessee? The local tax rate varies by county and/or city.

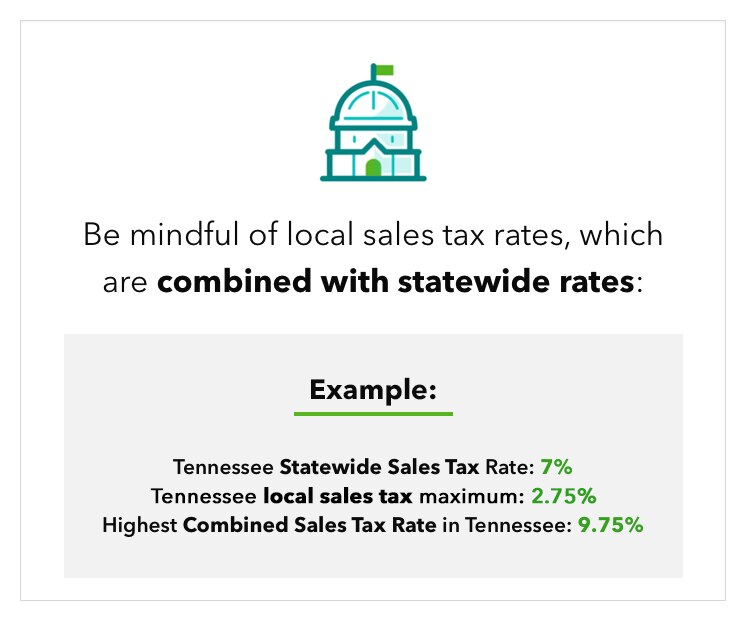

The general state tax rate is 7%. What is the tax rate range for tennessee?

Then, Identify The Local Sales Tax Rates, Varying Across Counties, Cities, And Districts.

Putting everything together, the average cumulative sales tax rate in the state of tennessee is 9.61% with a range that spans from 8.5% to 9.75%.

Tax Rates Are Provided By Avalara And Updated Monthly.

The local tax rate varies by county and/or city.

The Average Sales Tax Rate In Tennessee In 2024 Is 7%.

Images References :

Source: wisevoter.com

Source: wisevoter.com

Sales Tax by State 2023 Wisevoter, Wilson county sales tax rate. The general state tax rate is 7%.

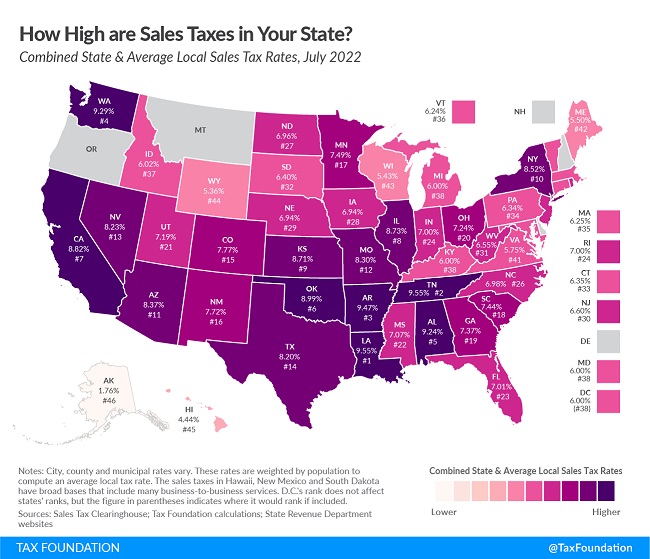

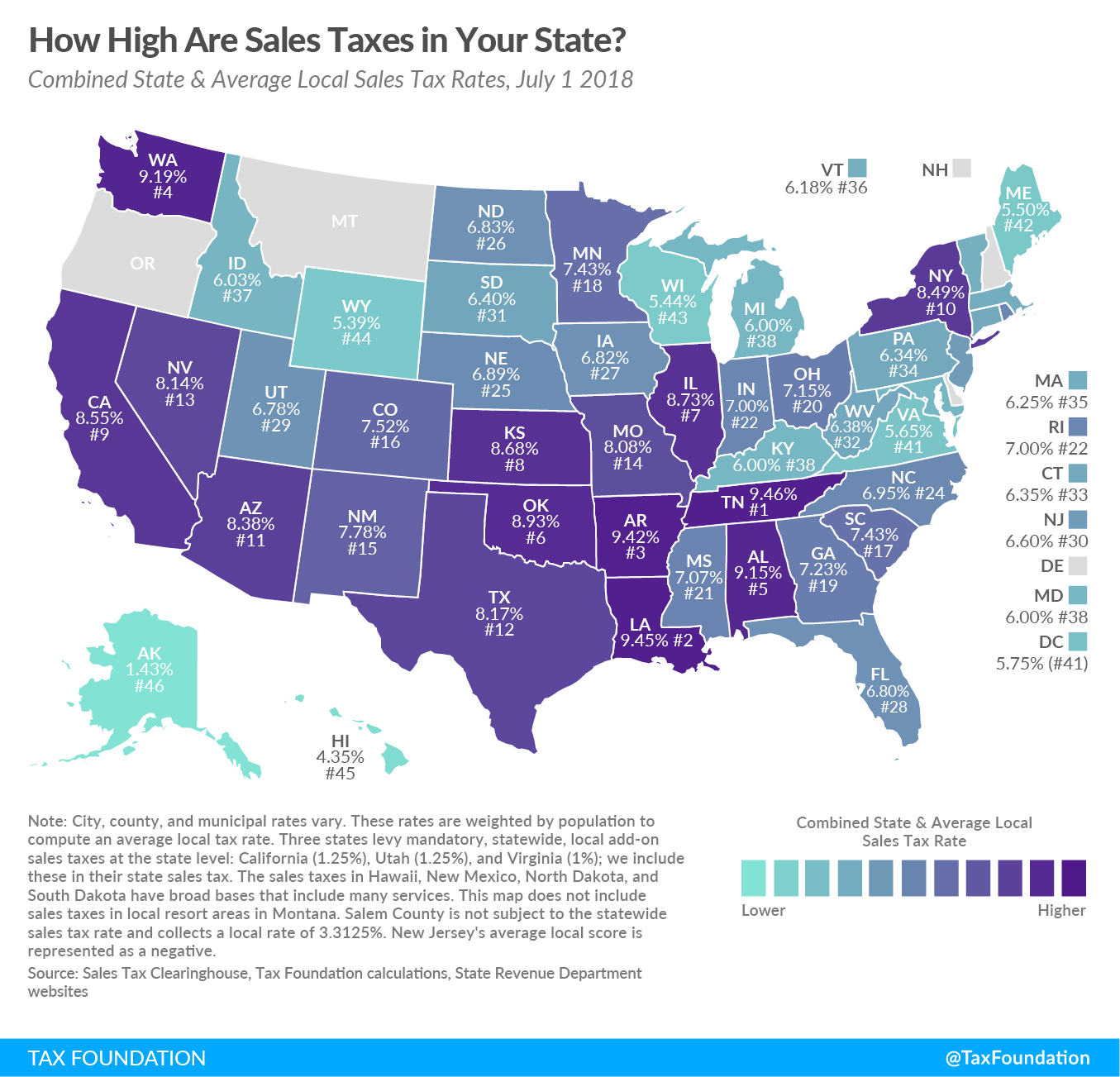

Source: taxfoundation.org

Source: taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, View a detailed list of local sales tax rates in. The local tax rate varies by county and/or city.

Source: calculator-online.info

Source: calculator-online.info

Tennessee Sales Tax Calculator State, County & Local Rates, The general sale tax rate for most tangible personal property and taxable services is 7%. You can use this simple tennessee sales tax calculator to determine the sales tax owed, and total price including tax, by entering the applicable sales tax rate and the purchase.

Source: www.newtaxdeductions.com

Source: www.newtaxdeductions.com

The latest changes in the tax law that will effect you. New Tax, The streamlined sales and use tax project is a national effort by states to simplify and modernize administration of state and local sales and use tax laws. This page lists an outline of the sales tax rates in tennessee.

Source: pbn.com

Source: pbn.com

Tax Foundation R.I. state sales tax second highest in country, This page lists an outline of the sales tax rates in tennessee. 7% is the smallest possible tax rate (denver, tennessee) 8.5%, 9%,.

Jenniffer Comstock, Wilson county sales tax rate. The general sale tax rate for most tangible personal property and taxable services is 7%.

Source: 1stopvat.com

Source: 1stopvat.com

Tennessee Sales Tax Sales Tax Tennessee TN Sales Tax Rate, Exemptions to the tennessee sales tax. Then, identify the local sales tax rates, varying across counties, cities, and districts.

Source: www.pinterest.com

Source: www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, Tennessee state, county & city sales tax rates 2024. 7% is the smallest possible tax rate (denver, tennessee) 8.5%, 9%,.

Source: www.nashvillescene.com

Source: www.nashvillescene.com

Tennessee Now Has the Highest Sales Tax in the Country Pith in the, Exemptions to the tennessee sales tax. The local tax rate varies by county and/or city.

Source: quickbooks.intuit.com

Source: quickbooks.intuit.com

Understand state sales tax nexus QuickBooks, The general state tax rate is 7%. Look up 2024 sales tax rates for knoxville, tennessee, and surrounding areas.

Putting Everything Together, The Average Cumulative Sales Tax Rate In The State Of Tennessee Is 9.61% With A Range That Spans From 8.5% To 9.75%.

Please refer to the tennessee website for more sales taxes information.

Please Click On The Links To The Left For More Information About Tax Rates, Registration And Filing.

The general state tax rate is 7%.